Embarking upon the voyage into equity investments presents an exhilarating endeavour for novices. This odyssey is adorned with education and potential financial prosperity. Whether you aspire to augment your retirement savings, cultivate a stream of passive revenue, or enhance your fiscal wealth, comprehending the beginner guide to stock investing marks the commencement of your quest towards realizing your budgetary ambitions. This discourse endeavours to give you the insight and assurance required to initiate your expedition in the equity market.

Grasping Fundamental Concepts

Mastering its foundational principles is imperative before plunging into the stock market's intricacies. Equities signify ownership stakes in corporations. Acquiring equity implies a portion of said corporation is yours, establishing you as a shareholder. Shareholders are poised to benefit from the company's profits through dividends and stock value appreciation over time.

The Merits of Equity Investment

● The prospect of Substantial Returns: Over the long term, equities have consistently outperformed other investment vehicles, such as bonds or savings deposits, in terms of yield.

● Fluidity: Equities offer the convenience of prompt buying and selling within the market, ensuring the accessibility and liquidity of your assets.

● Risk Dispersion: Investing across diverse equities can mitigate risk and elevate the return on your investment.

Embarking on Equity Investment

Venturing into equity investments necessitates deliberate planning and contemplation. Herein are the foundational steps to undertake:

1. Articulate Financial Aspirations: Define your investment objectives. These could range from accruing funds for retirement to realizing immediate financial gains.

2. Cultivate Financial Literacy: Dedicate time to understanding the stock market, various equity categories, and methodologies for evaluating a company’s fiscal health. Emphasizing the beginner guide to stock investing is crucial here.

3. Selection of a Brokerage Service: Opt for a brokerage that aligns with your investment strategy, preferences, and fiscal considerations. Take into account aspects like fees, analytical resources, and user interface.

4. Commence Conservatively: Initiate with a modest investment you can afford to forfeit. Accumulating experience without jeopardizing your financial security is pivotal; this is one of the first steps in stock investing.

Initiating in the Equity Market

Crafting a Heterogeneous Portfolio

The essence of risk management within your investment portfolio lies in diversification. This strategy involves spreading your investments across diverse sectors and industries. A portfolio characterized by diversity can aid in navigating market fluctuations and securing more consistent returns over time. This diversification is a fundamental aspect of starting in the stock market.

Equity Analysis

When selecting equities, it's essential to evaluate the company's financial stability, market standing, growth prospects, and macroeconomic factors. Such scrutiny aids in making enlightened decisions and picking equities that resonate with your investment ambitions. For those starting in the stock market, this analytical step is indispensable.

Advanced Investment Techniques

With accrued experience, you might explore sophisticated investment methodologies. These include:

● Investment in Undervalued Entities: Concentrating on companies that the market undervalues.

● Growth Investment: Targeting companies anticipated to grow at an accelerated rate compared to their peers.

● Dividend Investment: Focusing on companies with a history of paying substantial dividends.

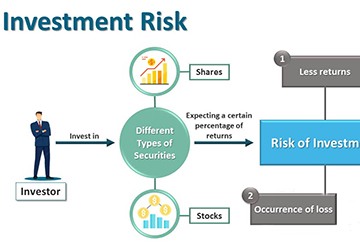

Investment Risks and Deliberations

While equities present an opportunity for lucrative returns, they are full of risks. Market fluctuations, economic shifts, and company-specific developments can impact stock prices. It's prudent to invest within your financial capacity to absorb losses and maintain a long-term investment perspective.

Elevating Your Acumen in Equity Investment

Fostering Financial Sagacity

As you delve into the depth of your investments, your business will grow from initial familiarity to profound insight. Enriching your knowledge spectrum involves more than just the intake of information; it encompasses analytical thinking and applying principles in dynamic market contexts. Advancing past the beginner guide to stock investing entails the development of a sophisticated grasp on market forces, the psychology of investing, and the art of strategic allocation of assets.

The Emotional Terrain of Investment

The investor's psyche is central to the investment decision-making matrix. Sentiments such as apprehension and avarice can drastically influence investment decisions and outcomes. Achieving mastery over emotional equilibrium and nurturing forbearance are essential skills for triumph in stock investment. Delving into the study of behavioural finance sheds light on prevalent biases affecting investor actions, aiding in pursuing more informed decision-making.

Deliberate Allocation of Assets

The asset allocation strategy involves the reasonable distribution of investments across various asset categories (e.g., equities, bonds, tangible assets) to strike an optimal balance between risk and reward. Progressing beyond the first steps in stock investing, acquiring the skill to customize your investment portfolio in alignment with your risk appetite and temporal investment goals is paramount. This strategic approach necessitates regular evaluations and adjustments of your portfolio to ensure it remains in sync with your enduring financial aspirations.

Harnessing Sophisticated Analytical Instrumentation

In today's technologically driven era, investors have access to an expansive suite of advanced instruments and digital platforms that furnish profound insights into market fluctuations, detailed analyses of individual stocks, and the oversight of investment portfolios. Engaging with these resources can significantly augment your capacity for making well-informed decisions:

● Technical Analysis Applications: These digital tools help decipher market tendencies and patterns by examining historical financial data and technical indicators.

● Investment Portfolio Management Solutions: Provide an all-encompassing snapshot of your investments, key performance indicators, and notifications for portfolio realignment.

Conclusion

Commencing your equity market journey is an enlightening learning and growth process. By adhering to a beginner guide to stock investing, delineating clear objectives, and progressively cultivating your portfolio, you can traverse the equity market with poise.

Remember, the path to investment success is akin to a marathon, demanding patience and steadfastness. You can achieve your financial goals and ensure a prosperous fiscal future with diligence and commitment.

Taking the first steps in stock investing and entering the stock market with the right mindset and strategies can set the foundation for a successful investment journey. Welcome to the stimulating domain of equity investing!