Venturing through the tumultuous realms of an economic contraction demands understanding, particularly in pinpointing the opportune moments for timing stock buys in bear market scenarios. This manual is designed to illuminate the path, offering strategic counsel on when to invest in downturns and formulating a fortified bear market investment strategy.

Deciphering Bear Markets

Grasping the essence of bear markets is pivotal for leveraging investment opportunities. Defined by a decline exceeding 20% from peak values, bear markets symbolize widespread pessimism and a hostile investment climate. Early recognition of these conditions primes investors for making enlightened decisions.

Hallmarks of Economic Retractions

● Notable declines in market indices

● Continuous downward trajectories in equity prices

● Indicators of economic regression, such as rising unemployment figures

Blueprints for Equity Purchases in Bear Markets

1. Evaluating Economic Resilience

A cornerstone of any bear market investment strategy is meticulously evaluating target entities' economic resilience. Prioritize entities with robust fiscal structures, minimal indebtedness, and steady revenue streams. These characteristics suggest an entity's capability to endure financial downturns.

2. Pursuit of Intrinsic Worth

The pursuit of undervalued equities becomes especially pertinent during bear markets. Aim to identify stocks priced below their actual value, but exercise diligence to discern between genuinely undervalued assets and those cheap for substantiated reasons.

3. Optimal Timing for Equity Purchases in Bear Markets

The essence of timing stock buys in bear market landscapes lies in identifying fortuitous junctures rather than exacting the nadir of market valuations. Adopting a strategy of dollar-cost averaging can temper risk exposure. This method involves consistent investment of fixed sums over intervals, allowing for the acquisition of more shares at lower prices and fewer at elevated prices.

Opting for Investments During Downturns

Spotting the Revival

Forecasting market recoveries is infamously complex, yet specific indicators can suggest an impending upturn:

● Stabilization of market indices

● Amelioration of economic indicators

● Shifts towards positive market sentiment

Adopting a Longitudinal Viewpoint

Deciding when to invest in downturns necessitates a vision extending beyond the immediate horizon. Bear markets can unveil remarkable acquisition opportunities for the patient investor, predicated on the assets' long-term viability rather than temporary gains.

Constructing a Bear Market Investment Framework

A strategic bear market investment strategy is characterized by portfolio diversification and an emphasis on quality. Spreading investments across various sectors and asset categories can dilute risk while concentrating on premium investments, which offers a buffer against market volatility.

Key Considerations

● Effective timing stock buys in bear market conditions revolves around seizing opportune moments rather than pinpointing market bottoms.

● Portfolio diversification is essential for risk management during bear markets.

● In pursuit of undervalued stocks, prioritize companies exhibiting solid financial health as part of your bear market investment strategy.

● A longitudinal investment perspective is vital when investing in downturns.

● Dollar-cost averaging stands out as a prudent approach to mitigate risk.

Elevated Strategies for Maximizing Returns in Economic Dips

Innovative Portfolio Expansion and Resource Allocation

Venturing beyond conventional investment wisdom to embrace an expansive array of assets becomes imperative during economic downturns. Forward-thinking investors diversify their portfolios to encompass non-traditional assets, erecting a formidable defence against stock market volatility. Tailoring asset allocation according to individual risk tolerance and overarching financial objectives evolves into a proactive strategy for safeguarding and enhancing portfolios amidst economic uncertainties.

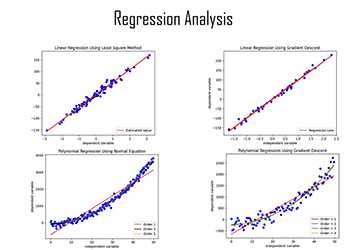

Harnessing Advanced Quantitative Techniques

Leveraging sophisticated quantitative methodologies to assess potential investments meticulously confers a definitive edge in bear markets. Harnessing intricate algorithms and models, such as regression analysis, Monte Carlo simulations, and artificial intelligence prognostications, can enhance the precision of predicting price fluctuations and identifying undervalued equities. Adopting advanced tools bolsters investment selection, anchoring decisions in resilient analytical evidence and forward-looking insights.

Cultivating Emotional Resilience in Financial Ventures

Grasping the Nuances of Behavioral Economics

The interplay between psychology and investment is critical, especially during bear markets. Insights from behavioural economics reveal how emotional responses can lead to suboptimal financial choices, including precipitous selling or following the crowd without question. Investing in knowledge about these psychological traps and constructing a strategy to navigate emotional impulses can markedly elevate the quality of investment decisions.

Embracing a Contrarian Investment Stance

The contrarian investment philosophy—seeking opportunities in sectors or assets currently out of favour—can yield significant rewards during market downturns. This approach demands meticulous research and the courage to stand firm against mainstream market views. Investors with a contrarian lens often identify high-value assets overlooked or discarded by the market, capitalizing on these opportunities when sentiment shifts.

Incorporating Technical Insights into Fundamental Analyses

Blending fundamental analysis with technical insights can uncover opportune moments for transaction execution. Examining market signals such as price trends, trading volumes, and historical patterns offers insights into potential market shifts or the persistence of current trends. This hybrid approach fine-tunes the precision of entry and exit strategies, amplifying the efficacy of investment tactics.

Ensuring Portfolio Endurance Against Future Shifts

Agility in Response to Market Evolution

The landscape of financial markets is ever-changing, propelled by technological breakthroughs, geopolitical dynamics, and shifts in consumer behaviour. An alert and informed stance on global developments and their potential ripple effects across industries is indispensable for the timely adaptation of investment strategies. Flexibility and a proactive attitude towards adjusting investment approaches in light of emerging information are paramount for proficiently steering through bear market challenges.

Prioritizing Investments with a Conscience

The surge in sustainable investment reflects a growing awareness of the importance of environmental, social, and governance (ESG) considerations. In times of economic contraction, enterprises with solid ESG credentials tend to outperform, drawing investors seeking financial stability and a positive societal impact. Integrating ESG considerations into investment criteria can reveal opportunities that marry financial prosperity with advancing global sustainability objectives.

Conclusion

While bear markets might appear foreboding, they also present unparalleled opportunities for the discerning investor. By concentrating on timing stock buys in bear market scenarios, implementing strategic measures when to invest in downturns, and developing a robust bear market investment strategy, investors can position themselves for potentially substantial gains. Patience, meticulous research, and a disciplined strategy are indispensable in mastering the intricacies of bear market investment.